How to add sparklines to a {gt} table

Any table can be spiced up by adding small visual elements to it. Ideally, this makes the table more engaging and informative. One popular visual element that can get both jobs done is a sparkline .

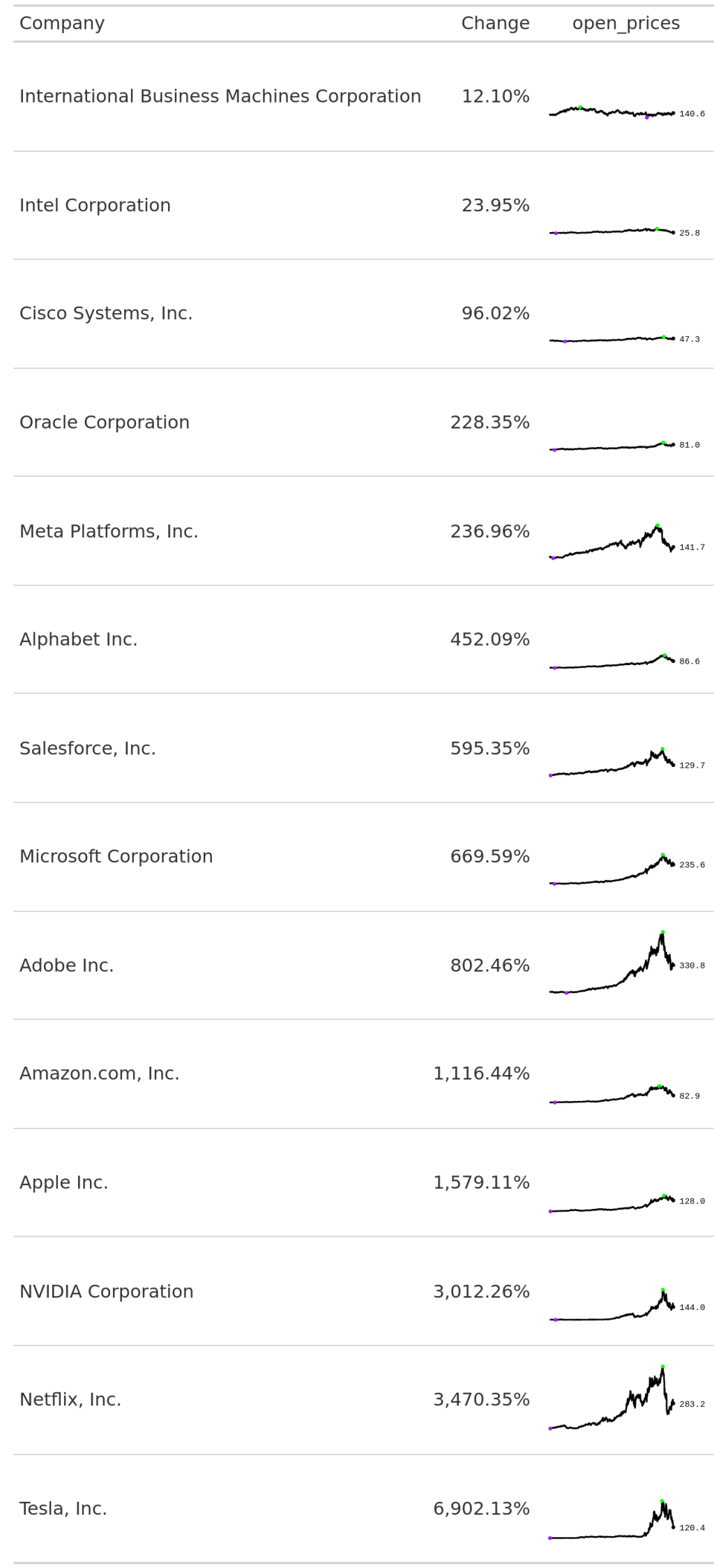

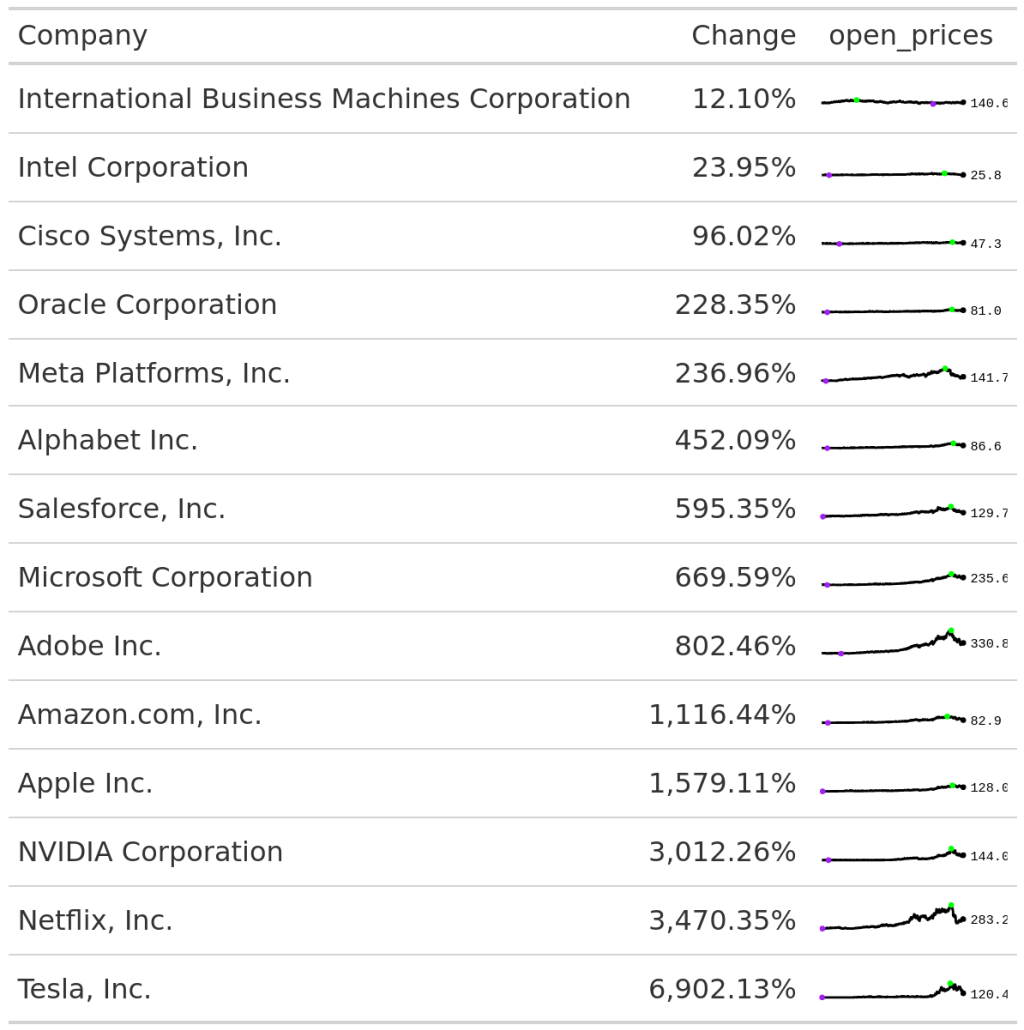

These are little line charts in a table cell that can give you a miniature overview of a time series evolution over time. Sounds complicated? It probably becomes clear when you see it in action. Here, have a look:

See those little lines. They show you exactly how the open price of the stock prices evolved over time. Seeing this can give you more information on the volatility of a stock. And in gt it’s pretty easy to create such a line chart. Let me show you how.

Grab the data

Let’s first grab the data that was used in the above table. In this case, the data comes from a TidyTuesday challenge . This means we can download the data by executing this code chunk:

library(tidyverse)

big_tech_stock_prices <- readr::read_csv('https://raw.githubusercontent.com/rfordatascience/tidytuesday/master/data/2023/2023-02-07/big_tech_stock_prices.csv')

big_tech_stock_prices

#> # A tibble: 45,088 × 8

#> stock_symbol date open high low close adj_close volume

#> <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

#> 1 AAPL 2010-01-04 7.62 7.66 7.58 7.64 6.52 493729600

#> 2 AAPL 2010-01-05 7.66 7.70 7.62 7.66 6.53 601904800

#> 3 AAPL 2010-01-06 7.66 7.69 7.53 7.53 6.42 552160000

#> 4 AAPL 2010-01-07 7.56 7.57 7.47 7.52 6.41 477131200

#> 5 AAPL 2010-01-08 7.51 7.57 7.47 7.57 6.45 447610800

#> 6 AAPL 2010-01-11 7.6 7.61 7.44 7.50 6.40 462229600

#> 7 AAPL 2010-01-12 7.47 7.49 7.37 7.42 6.32 594459600

#> 8 AAPL 2010-01-13 7.42 7.53 7.29 7.52 6.41 605892000

#> 9 AAPL 2010-01-14 7.50 7.52 7.46 7.48 6.38 432894000

#> 10 AAPL 2010-01-15 7.53 7.56 7.35 7.35 6.27 594067600

#> # ℹ 45,078 more rows

Get company names

Unless you’re into stocks, you probably won’t know which companies the abbreviations in the stock_symbol represent. Thankfully, TidyTuesday also offers a dictionary for that. We can download it from GitHub as well.

big_tech_companies <- readr::read_csv('https://raw.githubusercontent.com/rfordatascience/tidytuesday/master/data/2023/2023-02-07/big_tech_companies.csv')

big_tech_companies

#> # A tibble: 14 × 2

#> stock_symbol company

#> <chr> <chr>

#> 1 AAPL Apple Inc.

#> 2 ADBE Adobe Inc.

#> 3 AMZN Amazon.com, Inc.

#> 4 CRM Salesforce, Inc.

#> 5 CSCO Cisco Systems, Inc.

#> 6 GOOGL Alphabet Inc.

#> 7 IBM International Business Machines Corporation

#> 8 INTC Intel Corporation

#> 9 META Meta Platforms, Inc.

#> 10 MSFT Microsoft Corporation

#> 11 NFLX Netflix, Inc.

#> 12 NVDA NVIDIA Corporation

#> 13 ORCL Oracle Corporation

#> 14 TSLA Tesla, Inc.

Now, we can combine those two data sets so that we have everything in one place.

big_tech_stock_prices |>

left_join(big_tech_companies, by = 'stock_symbol')

#> # A tibble: 45,088 × 9

#> stock_symbol date open high low close adj_close volume company

#> <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <chr>

#> 1 AAPL 2010-01-04 7.62 7.66 7.58 7.64 6.52 493729600 Apple In…

#> 2 AAPL 2010-01-05 7.66 7.70 7.62 7.66 6.53 601904800 Apple In…

#> 3 AAPL 2010-01-06 7.66 7.69 7.53 7.53 6.42 552160000 Apple In…

#> 4 AAPL 2010-01-07 7.56 7.57 7.47 7.52 6.41 477131200 Apple In…

#> 5 AAPL 2010-01-08 7.51 7.57 7.47 7.57 6.45 447610800 Apple In…

#> 6 AAPL 2010-01-11 7.6 7.61 7.44 7.50 6.40 462229600 Apple In…

#> 7 AAPL 2010-01-12 7.47 7.49 7.37 7.42 6.32 594459600 Apple In…

#> 8 AAPL 2010-01-13 7.42 7.53 7.29 7.52 6.41 605892000 Apple In…

#> 9 AAPL 2010-01-14 7.50 7.52 7.46 7.48 6.38 432894000 Apple In…

#> 10 AAPL 2010-01-15 7.53 7.56 7.35 7.35 6.27 594067600 Apple In…

#> # ℹ 45,078 more rows

Actually, we don’t need all of that data. Let’s just focus on the company names, the dates and the open prices.

open_prices_over_time <- big_tech_stock_prices |>

left_join(big_tech_companies, by = 'stock_symbol') |>

select(company, date, open)

open_prices_over_time

#> # A tibble: 45,088 × 3

#> company date open

#> <chr> <date> <dbl>

#> 1 Apple Inc. 2010-01-04 7.62

#> 2 Apple Inc. 2010-01-05 7.66

#> 3 Apple Inc. 2010-01-06 7.66

#> 4 Apple Inc. 2010-01-07 7.56

#> 5 Apple Inc. 2010-01-08 7.51

#> 6 Apple Inc. 2010-01-11 7.6

#> 7 Apple Inc. 2010-01-12 7.47

#> 8 Apple Inc. 2010-01-13 7.42

#> 9 Apple Inc. 2010-01-14 7.50

#> 10 Apple Inc. 2010-01-15 7.53

#> # ℹ 45,078 more rows

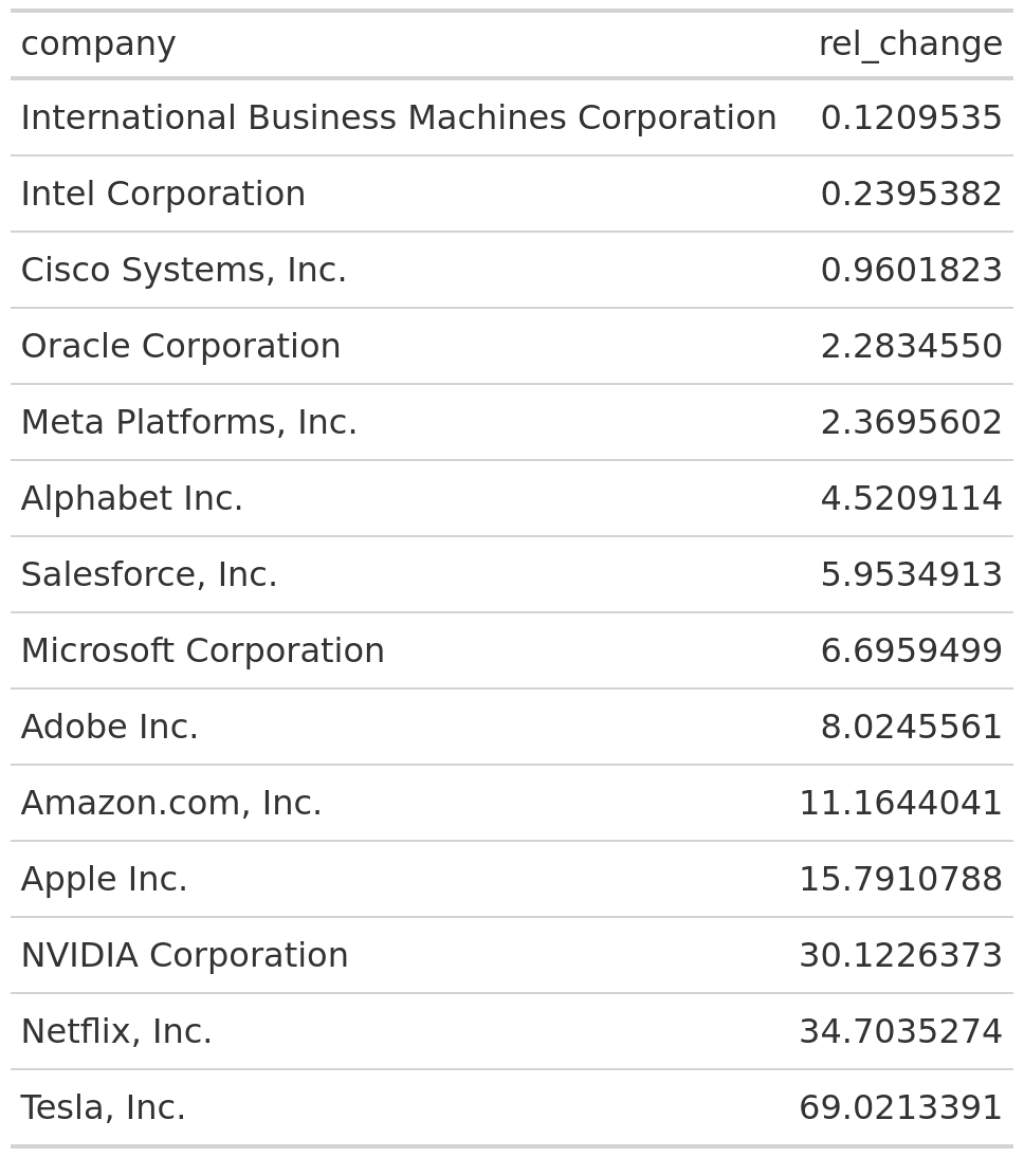

Summarize the data

Currently, the data set has ~45,000 rows. That’s way too big for a table. So let’s summarize that. Maybe we could just look how much each stock price increased from the earliest to the latest record in the data set. That could be interesting.

rel_changes <- open_prices_over_time |>

arrange(date) |>

summarize(

rel_change = open[length(open)] / open[1] - 1,

.by = company

) |>

arrange(rel_change)

rel_changes

#> # A tibble: 14 × 2

#> company rel_change

#> <chr> <dbl>

#> 1 International Business Machines Corporation 0.121

#> 2 Intel Corporation 0.240

#> 3 Cisco Systems, Inc. 0.960

#> 4 Oracle Corporation 2.28

#> 5 Meta Platforms, Inc. 2.37

#> 6 Alphabet Inc. 4.52

#> 7 Salesforce, Inc. 5.95

#> 8 Microsoft Corporation 6.70

#> 9 Adobe Inc. 8.02

#> 10 Amazon.com, Inc. 11.2

#> 11 Apple Inc. 15.8

#> 12 NVIDIA Corporation 30.1

#> 13 Netflix, Inc. 34.7

#> 14 Tesla, Inc. 69.0

Oh wow. Some stock prices increased by up to 6900%. That’s wild. Let’s put this into a table.

Get data into a

With gt it is pretty straight-forward to create a table. Just load the package and then pass your data set to the gt() function.

library(gt)

rel_changes |>

gt()

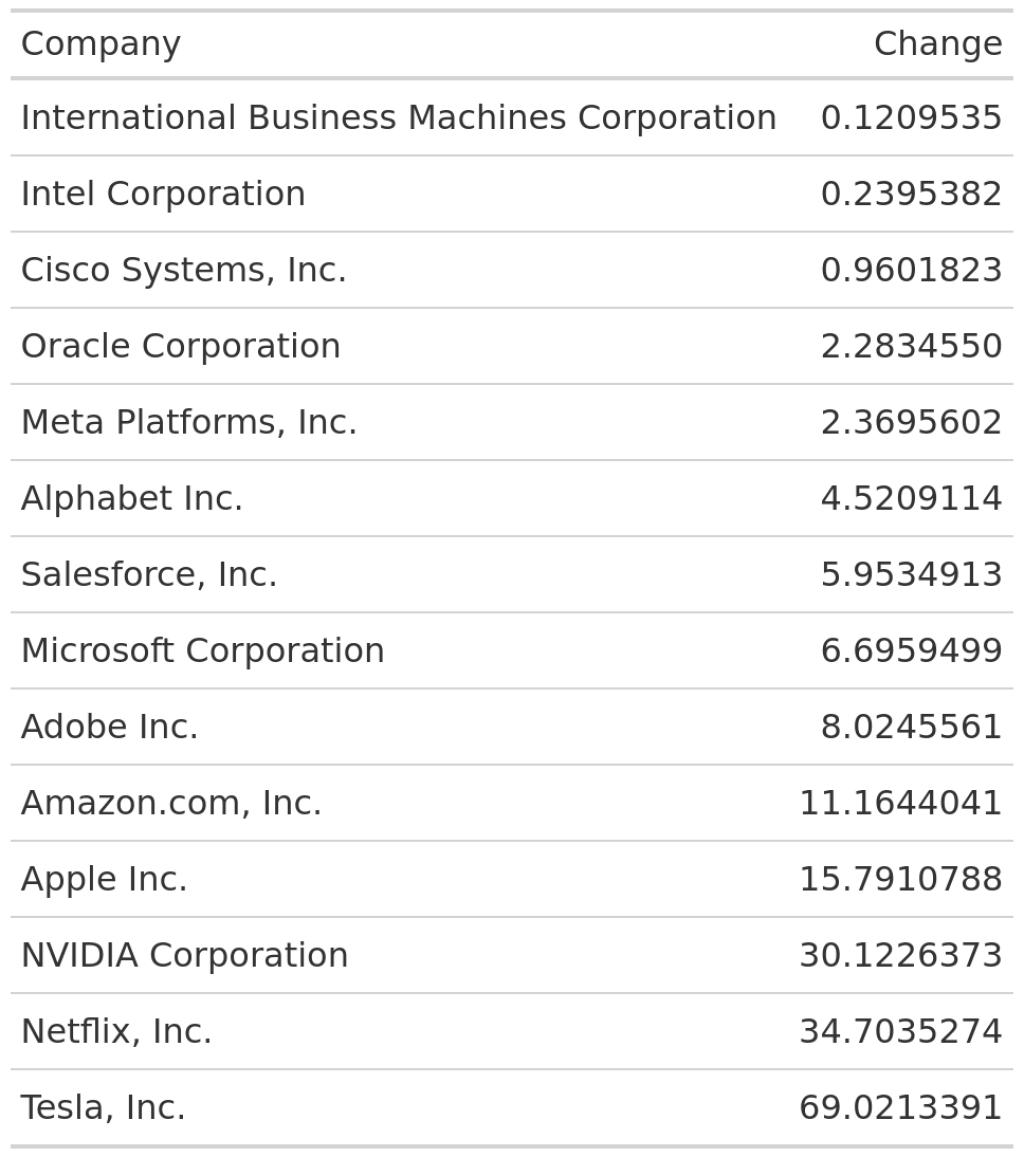

Right now, the column labels do not look that nice. Let’s change those to something more meaningful.

rel_changes |>

gt() |>

cols_label(

company = 'Company',

rel_change = 'Change'

)

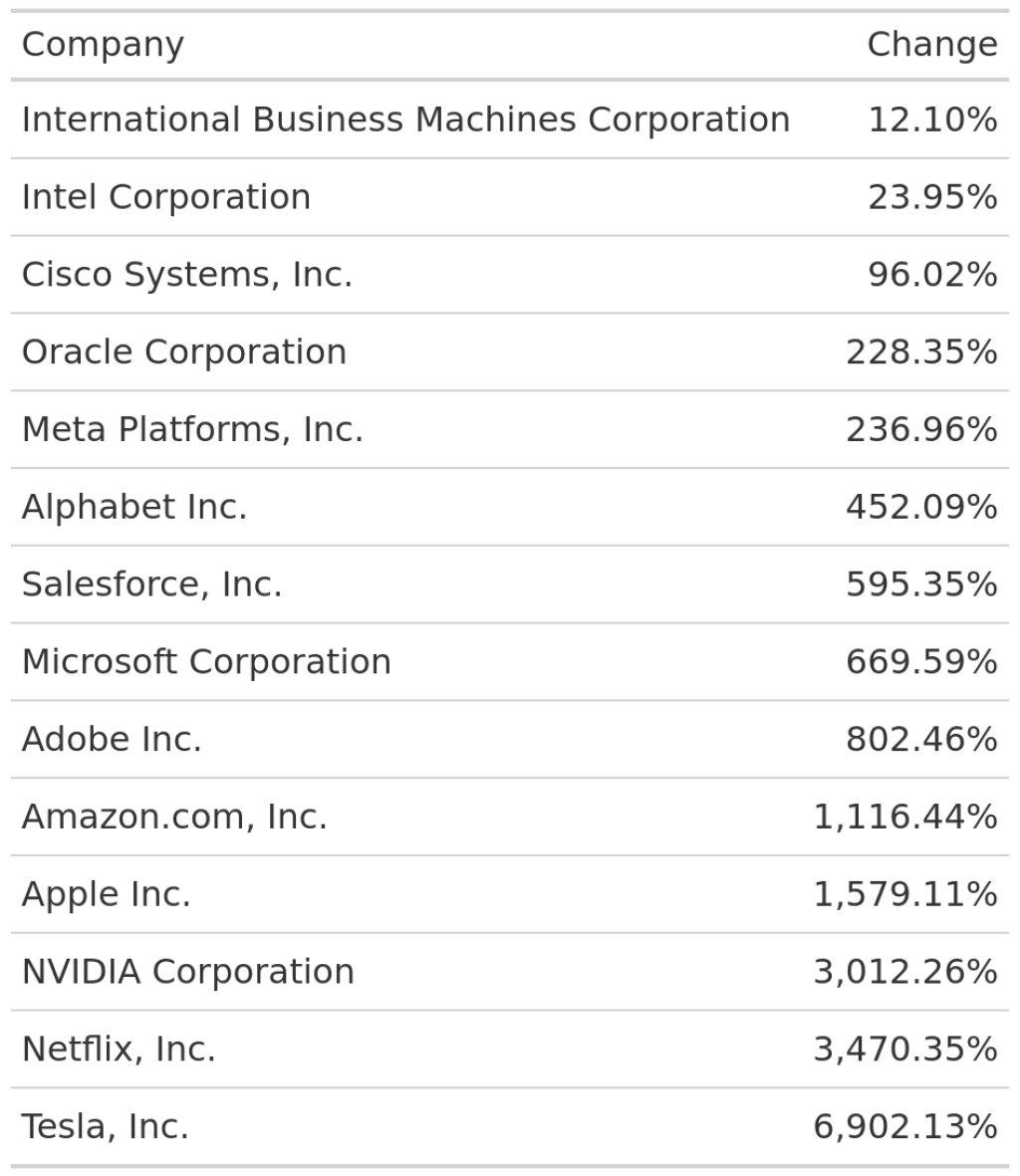

This looks a bit better. But to make sure that people understand that the second column means relative change, we might want to use percent labels in that column. No problem. The fmt_percent() function will do that for us.

rel_changes |>

gt() |>

cols_label(

company = 'Company',

rel_change = 'Change'

) |>

fmt_percent(columns = rel_change)

Cool! Much better. Of course, there’s still lots more to be done to make this table great . But let’s leave that aside and focus on the sparklines.

Get more information into the data set

To create the sparklines, we first need to get the data for that into the tibble that is passed to gt() . After all, how else is gt() supposed to know how the sparklines should look. So let’s modify the rel_changes data set to incorporate another column.

rel_changes <- open_prices_over_time |>

arrange(date) |>

summarize(

rel_change = open[length(open)] / open[1] - 1,

open_prices = list(open), # Add this line

.by = company

) |>

arrange(rel_change)

rel_changes

#> # A tibble: 14 × 3

#> company rel_change open_prices

#> <chr> <dbl> <list>

#> 1 International Business Machines Corporation 0.121 <dbl [3,271]>

#> 2 Intel Corporation 0.240 <dbl [3,271]>

#> 3 Cisco Systems, Inc. 0.960 <dbl [3,271]>

#> 4 Oracle Corporation 2.28 <dbl [3,271]>

#> 5 Meta Platforms, Inc. 2.37 <dbl [2,688]>

#> 6 Alphabet Inc. 4.52 <dbl [3,271]>

#> 7 Salesforce, Inc. 5.95 <dbl [3,271]>

#> 8 Microsoft Corporation 6.70 <dbl [3,271]>

#> 9 Adobe Inc. 8.02 <dbl [3,271]>

#> 10 Amazon.com, Inc. 11.2 <dbl [3,271]>

#> 11 Apple Inc. 15.8 <dbl [3,271]>

#> 12 NVIDIA Corporation 30.1 <dbl [3,271]>

#> 13 Netflix, Inc. 34.7 <dbl [3,271]>

#> 14 Tesla, Inc. 69.0 <dbl [3,148]>

Notice how we were able to get all of the open prices into one cell via the list() function in summarize() . Pretty cool, isn’t it? Now, we could pass this to data set to gt() like before.

rel_changes |>

gt() |>

cols_label(

company = 'Company',

rel_change = 'Change'

) |>

fmt_percent(columns = rel_change)

But if we did that, then all of the numbers would just be thrown into the table. That would be pretty terrible. Here’s how the first few rows of the new table would look.

Lines instead of numbers

To overcome this, let’s just tell gt() to make a line out of those numbers. Thankfully, another package, namely gtExtras , makes that pretty easy for us. All we need is the function gt_plt_sparkline() from that package.

rel_changes |>

gt() |>

cols_label(

company = 'Company',

rel_change = 'Change'

) |>

fmt_percent(columns = rel_change) |>

gtExtras::gt_plt_sparkline(column = open_prices)

That looks a little bit flat. We can make out that much. With the fig_dim argument, we can make the line charts a little bit larger.

rel_changes |>

gt() |>

cols_label(

company = 'Company',

rel_change = 'Change'

) |>

fmt_percent(columns = rel_change) |>

gtExtras::gt_plt_sparkline(

column = open_prices,

fig_dim = c(20, 40)

)

Ah that’s better. We can now see that some of these stocks had really huge jumps.

Conclusion

Nice, we have learned a quick way to add spark lines to our tables. 🥳 Clearly, one could customize this chart further. But that would bring us into realm where we have to combine ggplot2 and gt to add custom charts to the table. That would be a bit much to do here as well. But you can check out our other blog post that teaches you just that if you’re curious. Enjoy the rest of your day and see you next time 👋.

Sign up for the newsletter

Get blog posts like this delivered straight to your inbox.

You need to be signed-in to comment on this post. Login.